Meet Our Customer

Streamlining Insurance Underwriting with AI-powered Property Inspection*

Industry

Application

Results

Overview

Our customer is a leader in the emerging wave of AI-powered insurance technology. Their flagship product is a smart phone application that uses computer vision to assess and underwrite property risk, instead of relying on expensive in-person inspections. This unlocks a significantly more cost-effective and accurate assessment, while providing an easy and less-disruptive experience to the homeowner.

The process of underwriting and pricing a home insurance policy starts by understanding the risk associated with the property. To do so, insurance carriers need a clear assessment of property features – everything from the condition of the roof to the type of material used in the bathroom plumbing.

The traditional approach to collecting this information requires an inspector visit, which costs hundreds of dollars and is inconvenient and invasive for the homeowner.

Our customer disrupts these traditional approaches to underwriting with an AI-powered solution to property inspection – making it simpler for both underwriters and consumers to capture, store, and assess potential risks.

How the Tech Works

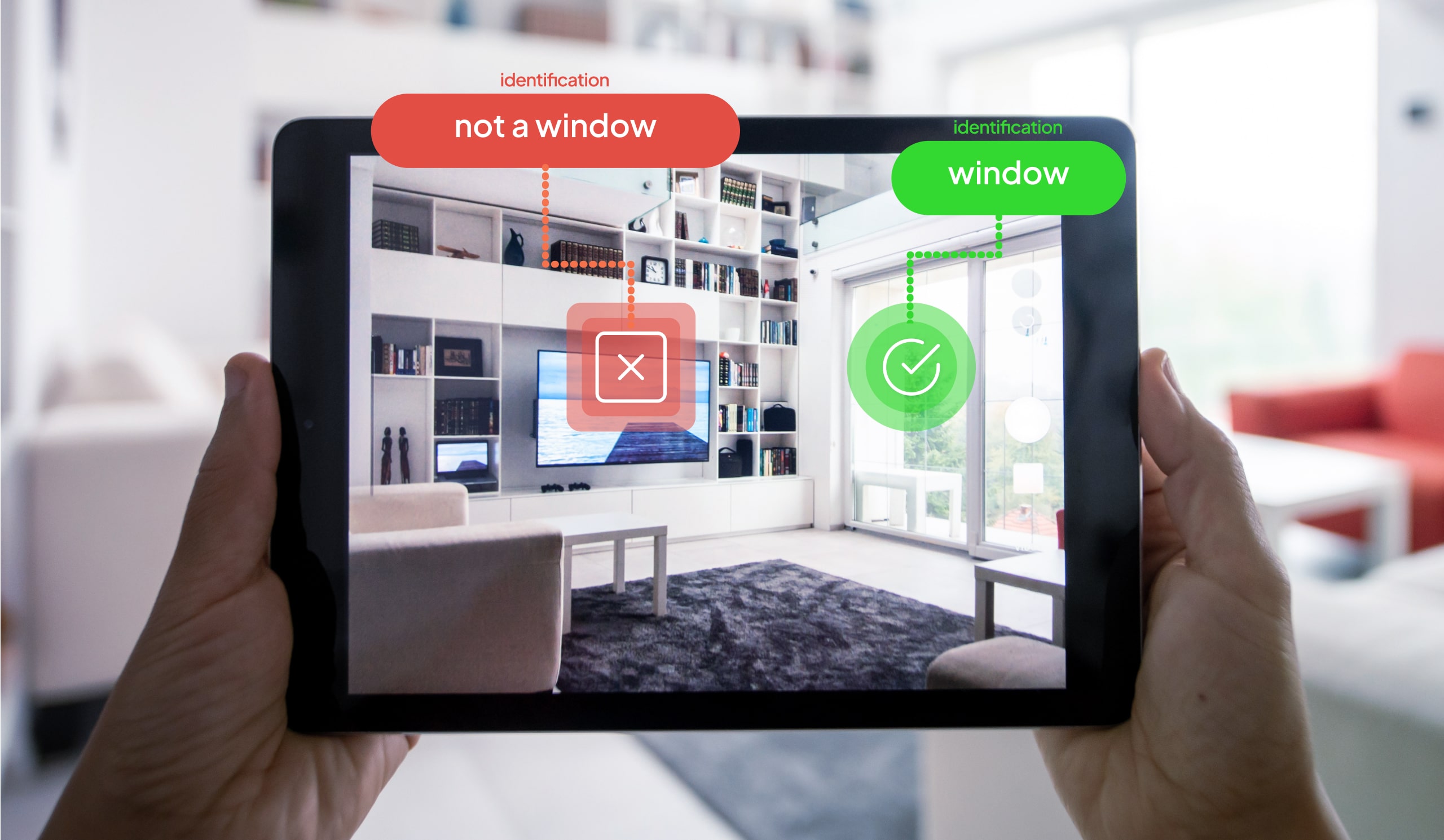

The homeowner uses our customer’s smartphone app to capture photos and videos of their property. Computer vision AI identifies the home’s features and then quickly provides a comprehensive assessment of the property’s underwriting risk. In a few quick pings, underwriters receive the analysis and perform complex, holistic risk assessments remotely.

The Challenge: Edge Cases Impede AI Property Assessments

Property inspections are fraught with challenges. They are carried out in homes that are actively lived in and as such can be disorganized and complex. There is infinite variability in how the homes were built, how they’ve aged, and how homeowners have personalized them. In addition, the quality of the photos taken by homeowners can vary. All of these factors make it nearly impossible for any AI to perfectly identify property features 100% of the time.

Prior to working with SparkAI, two major edge case problems persisted:

- Some features confused the AI. A feature could look different across two or more properties, and superficial differences could cause the AI to identify the feature incorrectly. (For instance, a covered in-ground pool is hard to identify for models trained on uncovered pools). In other instances, two features that looked similar to each other were in fact different features altogether (“Is that a window view or a landscape painting?”).

- Low-quality photos. Consumers’ photographs are marred by poor lighting conditions, photo angles, or other clarity issues. Such suboptimal imaging challenged our customer’s model. Minute, yet crucial, details for the inspection emerged:

- “Are those tangled wires fraying or not?”

- “Is that radiator touching the bed, or simply near it?”

- “Are these two photos from the same room?”

- “What in the world is in this image?”

Edge Case Costs:

Before our customer began working with SparkAI, edge cases jeopardized the commercialization of their product, threatening:

- Viability. Edge cases resulted in the AI’s failure to reliably recognize and analyze property features 100% of the time. The critical, albeit relatively small, gap in accuracy would have posed too many risks. Customers would have to redo assessments, undermining the product’s appeal.

- Insurance Carrier Confidence. Upending traditional in-person inspections and unlocking adoption and scale of this product was only possible if insurance carriers (and homeowners) had unwavering confidence in the accuracy of the product.

Unlocking adoption and scale of this product was only possible if insurance carriers had unwavering confidence in the accuracy of the product.

The Solution: SparkAI Provides the Missing Context

Now, when our customer’s AI model lacks confidence, it calls SparkAI. We use a combination of human cognition and proprietary software to quickly evaluate the property “scene” and provide missing context back to the model. This supports the model’s ability to analyze properties, resulting in clear outputs that underwriters can use to complete accurate, precise, and speedy assessments.

SparkAI’s highly nuanced, subjective work is the kind that humans are uniquely poised to do. Hundreds of millenia of evolution has made humankind naturally adept at identifying the potential risks, harm, or damage that could occur (or are already occurring) in any scene – in just an instant.

In order to channel this uniquely human capability to handle intricate, subjective tasks like those in our customer’s use case, a rigorous training and assessment process was applied to certify our Mission Specialists. Those vetted for the training program underwent thorough background checks and use case-specific training. They needed to demonstrate considerable aptitude across spatial, logical, and technical reasoning, a nuanced understanding of complex property features and related terminology, and a full understanding of and commitment to our customer's custom data security, data privacy, and business requirements. Finally, mission specialist training was considered complete only after they achieved the highest marks on a bespoke testing module that we created for our customer’s particular use case – designed and executed in SparkAI’s platform.

The Results: Unprecedented Scale and Reliability

With edge cases solved, our customer is outperforming competitors and quickly capturing even more share of the fast-growing $843 billion casualty and direct insurance market.

Our customer is scaling quickly to meet the demand for this sophisticated AI product – satisfying a pressing problem for the next-generation of “exponential underwriters.” Their existing insurance carrier customers are satisfied with the product, and new customers are drawn in by this cost-effective, convenient, and easy-to-use service.

Knowing that SparkAI is here to solve their edge case problems, our customer is looking toward their future offerings with refreshed confidence and boldness. They aim to launch new AI features and products in shorter cycles, which will provide them with more immediate return on their AI investments and further bolster their market position.

*SparkAI takes confidentiality seriously. This customer prefers to remain anonymous.